Why is the crypto market crashing today?

Introduction

Why is the crypto market crashing today? (Sep. 4 in 2025)”—that is the question dominating headlines, social media threads, and trading floors across the globe. After weeks of optimism, the cryptocurrency market has entered a turbulent phase, with Bitcoin, Ethereum, and many altcoins facing heightened volatility. Traders are watching charts nervously, institutional investors are reassessing risk, and newcomers are wondering if this is a routine dip or the start of something more serious.

On September 4, 2025, the crypto market is wobbling under the weight of multiple converging pressures. Prices are being pulled in different directions by asset rotation between Bitcoin and Ethereum, seasonal weakness that often strikes in September, and technical sell signals flashing across major charts. At the same time, the market faces macroeconomic uncertainty linked to Federal Reserve policies, growing regulatory scrutiny of crypto-linked equities, and thin liquidity due to recent holiday trading lulls.

But not all forces are negative. Beneath the current turbulence lie structural strengths—reduced exchange reserves, strong ETF inflows, and ample stablecoin liquidity—that suggest this crash may not be a full-scale collapse, but rather a correction within a larger bullish cycle. The challenge for investors is to separate short-term noise from long-term fundamentals.

In this article, we’ll break down the many layers of today’s downturn. We’ll analyze asset flows, seasonal patterns, institutional behavior, technical signals, macro trends, regulatory developments, and investor psychology. By the end, you’ll have a clear, data-driven understanding of why the crypto market is crashing today (Sep. 4 in 2025), and what it means for the road ahead.

What’s happening in the markets today (Sep. 4, 2025)

- Bitcoin is seeing a slight decline of about 0.4%, hovering near $111,000, while Ethereum is trending up slightly, around +0.9% to $4,392

- Meanwhile, 70 of the top 100 coins are in the red, though Ethereum and a few others buck the trend

- This uneven performance highlights a redistribution of capital and selective optimism despite broader market caution.

1. Asset rotation: from Bitcoin to Ethereum and altcoins

One of the clearest answers to why the crypto market is crashing today (Sep. 4 in 2025) lies in asset rotation. According to analysts like Sergei Gorev of YouHodler, many investors are “cautiously strengthening their positions in ETH by selling BTC.” This shift is not simply bearish it reflects a broader strategic repositioning across the crypto ecosystem.

Why investors are rotating out of Bitcoin

- Profit-taking on recent highs: Bitcoin rallied strongly in August, and some large holders are taking profits while the asset is still trading near six-figure levels.

- Ethereum’s rising appeal: ETH continues to attract capital thanks to the expansion of decentralized finance (DeFi), high staking yields through proof-of-stake mechanisms, and growing acceptance of Ethereum-based ETFs.

- Altcoin ecosystem momentum: Beyond Ethereum, projects like Solana, Avalanche, and Layer-2 scaling solutions are gaining market share due to faster transaction speeds, lower fees, and strong developer adoption.

What this rotation means for the market

- Short-term pressure on BTC: As capital exits Bitcoin, its dominance weakens, amplifying the perception of a downturn even if the funds are staying within the crypto ecosystem.

- Selective gains elsewhere: While Bitcoin may appear to be “crashing,” Ethereum and other altcoins are showing resilience, with some even posting daily gains. This explains why not all coins are in free fall despite Bitcoin’s dip.

- Sign of a maturing market: In earlier cycles, Bitcoin dictated nearly all of crypto’s direction. Today, asset rotation suggests that investors are differentiating between projects and allocating capital more selectively—a hallmark of a more sophisticated market.

Investor psychology behind the move

- Risk-reward balance: Ethereum’s yield opportunities through staking appeal to investors seeking steady returns rather than relying solely on price appreciation.

- Diversification: By reallocating into Ethereum and altcoins, investors hedge against Bitcoin’s short-term volatility while staying exposed to the broader crypto rally.

- Institutional adoption: The rise of Ethereum ETFs and increased institutional exposure to altcoins signal that Wall Street is no longer Bitcoin-only.

2. Seasonal weakness: September crypto blues

Historically, September is the weakest month for crypto, with average returns around –3.1% for Bitcoin and –12.7% for Ethereum

- Why?

- Profit-taking: Hype from summer peaks often gives way to rebalancing.

- Reduced liquidity: Thin trading during holidays can amplify moves.

- Macro headwinds: Seasonal cautiousness from institutional investors.

But 2025 may buck the trend:

- Exchange reserves are leaner, ETF inflows exceed $68B, and stablecoin supply is high—providing stronger buffer against traditional seasonal slide

3. Quarter-end institutional rebalancing pressures

Towards the month-end, institutional funds often rebalance portfolios, a process that can sell riskier assets like crypto to restore target asset allocations.

- Spot ETFs may see outflows, prompting market makers to liquidate holdings.

- Increased spreads and reduced liquidity can trigger cascading effects, especially if leveraged positions unwind near key price levels.

4. Liquidity crunch from holiday/thin markets

With Wall Street closures around Labor Day, institutional flows dipped, contributing to thinner order books.

Lower liquidity means even minor sell-offs may trigger outsized price moves.

5. Technical sell signals and liquidation zones

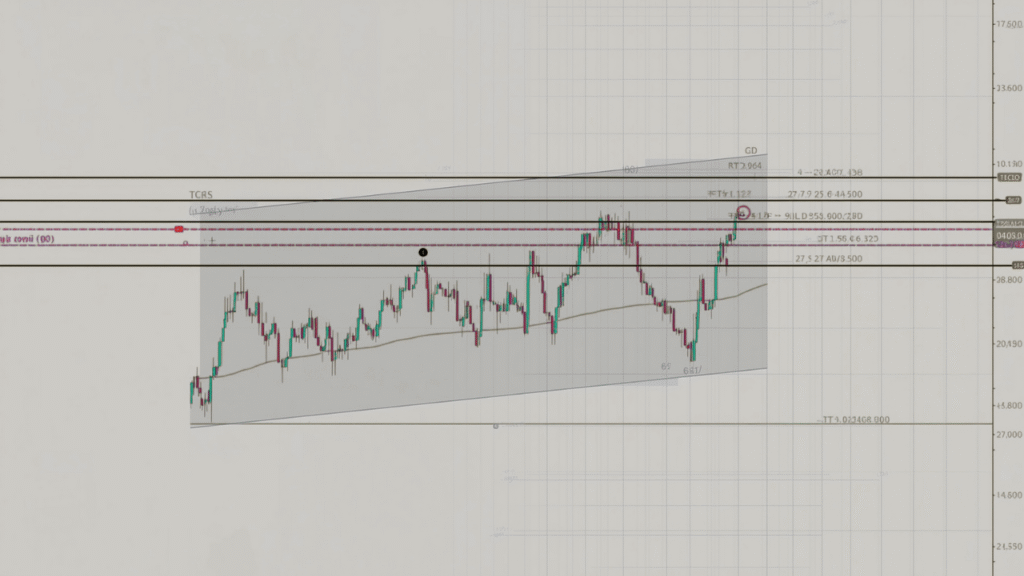

- Bitcoin trades below its 30-day moving average (~$113,500), 23.6% Fibonacci retracement (~$113,400), with MACD and RSI signaling bearish momentum.

- Support levels to monitor: $107K–$108K (immediate), followed by $105K–$103K if pressure continues.

- Decreased trading volume about 20% lower indicates weak buying interest, potentially lowering BTC toward $109K or, if breached, $106K.

6. Macro outlook: Fed rates, gold correlation, and safe-haven positioning

Despite market hopes for a Federal Reserve rate cut in September currently priced at 98% likelihood crypto patterns remain nuanced:

- Bitcoin is acting like a safe-haven, moving in sync with gold rather than risk-on assets.

- While typically a rate cut lifts risky assets, crypto’s emerging safe-haven status may mute this effect.

7. Equity vs crypto divergence and regulatory pressure

- American Bitcoin Company (ABTC) stocks are crashing—down ~16–17%—amid heightened regulatory scrutiny from Nasdaq and other bodies.

- Regulatory uncertainty and selective pressure on crypto-linked equities can bleed into broader sentiment, weighing on crypto prices.

8. Market psychology: FOMO hangover and cautious sentiment

In August, crypto soared to record highs, triggering intense fear of missing out (FOMO).

But swings this sharp often leave behind a hangover effect:

- Investors who chased earlier gains may now exit on any dip amplifying downward pressure.

- Experts suggest managing FOMO through diversification and focus on long-term well-being.

9. Market structure: thinner exchange reserves, ETF support, and stablecoin buildup

Good news: structural tailwinds still persist:

- Crypto exchange reserves are significantly lower Bitcoin reserves down from ~3M BTC to ~2.4M; Ethereum from ~19.3M to ~17.3M. Fewer coins on exchanges means less supply pressure.

- Institutional ETF inflows (~$68B+) and abundant stablecoin supply (~$55B) provide potential buying power to stem crash.

Synthesis: Why cryptocurrency is dipping today comprehensive summary

| Factor | Effect on Market |

|---|---|

| Asset Rotation (BTC → ETH / alts) | Weakens Bitcoin, supports altcoins |

| Seasonal September Sentiment | Adds typical downward pressure |

| Institutional Rebalancing | Selling pressure from portfolio resets |

| Low Liquidity (Holiday) | Amplifies any volatility |

| Technical Indicators | Bearish signals lower buyer confidence |

| Macro & Safe-Haven Behavior | Muted response to rate-cut optimism |

| Regulatory Scrutiny | Adds uncertainty, especially on equities |

| Market Psychology (Post-FOMO) | Prone to overreaction, rapid selling |

| Structural Support (Reserves, ETFs, Stablecoins) | Mitigates downside somewhat |

Conclusion: Why is the crypto market crashing today? (Sep. 4 in 2025)

So, why is the crypto market crashing today? (Sep. 4 in 2025) The answer is not a single headline event but a complex web of overlapping forces. Today’s downturn stems from several key drivers acting in unison:

- Asset rotation: Many investors are shifting capital from Bitcoin into Ethereum and promising altcoins, seeking better yield opportunities in staking and DeFi ecosystems. This naturally suppresses Bitcoin’s dominance and creates downward pressure on BTC prices.

- Seasonal turbulence: September has historically been the weakest month for cryptocurrencies. Traders often lock in summer profits, liquidity dries up, and institutional players adopt more defensive postures, magnifying downside volatility.

- Institutional repositioning: With the quarter-end approaching, large funds and ETFs are rebalancing their portfolios. Even modest sell-offs in the crypto allocations of major institutions can cascade across global exchanges, accelerating short-term declines.

- Liquidity gaps: The U.S. Labor Day holiday and related Wall Street slowdown have thinned order books. In this environment, even small sell orders can trigger exaggerated price swings, increasing market fragility.

- Technical bearish setups: From Bitcoin slipping below its 30-day moving average to RSI and MACD flashing weakness, technical traders are responding to multiple red signals. Automated liquidations near key support levels only worsen the downward slide.

- Macro and regulatory anxiety: On the macro side, investors are cautious about Federal Reserve policy, inflationary pressures, and how Bitcoin’s growing correlation with gold positions it as a safe haven rather than a growth asset. At the same time, fresh scrutiny of crypto-related equities, like ABTC, has spread a shadow of uncertainty over the sector.

- Residual post-FOMO sentiment: After August’s euphoric run to record highs, many traders are taking profits, while latecomers who bought at the top are capitulating. This combination of fear and regret fuels sharper sell-offs than fundamentals alone would dictate.

Why this may be a correction, not a full-scale crash

Despite today’s sell-off, the market’s structural underpinnings remain strong. Crypto exchange reserves are historically low, meaning fewer coins are readily available to dump on the market. ETF inflows remain robust, signaling steady institutional appetite. Stablecoin reserves continue to swell, representing latent buying power that can be quickly deployed to absorb dips.

In other words, while the current climate feels stormy, the foundations beneath the crypto market are sturdier than in past downturns. This suggests that today’s declines may represent a healthy correction within a larger bullish cycle, rather than the start of a prolonged bear market.

Key levels and signals to watch

- Bitcoin support zones: $107,000–$105,000 are the immediate lines in the sand. If breached, deeper retracements toward $103,000 could unfold. Holding these levels would reaffirm resilience.

- Trading volume and ETF flows: An uptick in institutional inflows could reverse sentiment quickly, while dwindling volume would extend the weakness.

- Macro indicators: Federal Reserve policy announcements, inflation reports, and gold market trends will continue to shape Bitcoin’s role as either a hedge or a risk asset. see