Is Unilabs the Next Solana? $30.3M Milestone Fuels 2025 Surge

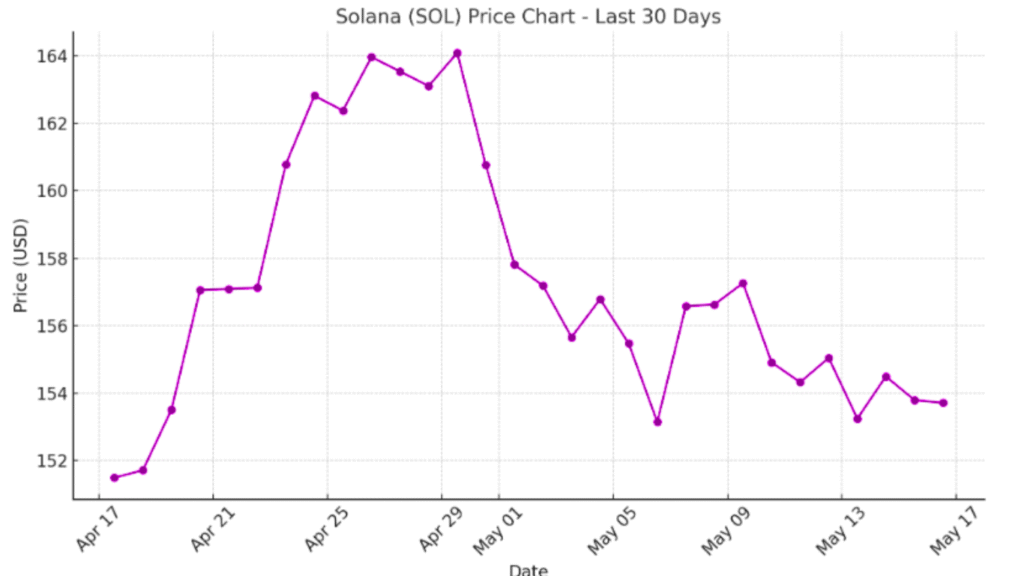

As the crypto market regains bullish momentum in 2025, all eyes are once again on Solana (SOL), one of the most prominent altcoins known for its high-speed transactions and scalable blockchain ecosystem. With Solana recording a monthly rally of over 30%, the market is buzzing with positive price predictions, hinting at a potential surge towards the $200 price mark.

But while Solana continues to dominate headlines, a new player has entered the scene, quietly but effectively building its empire: Unilabs (UNIL).

Unilabs is an AI-powered DeFi platform that has already surpassed $30.3 million in assets under management (AUM). With its innovative approach to automated asset management and affordable presale entry price of just $0.0051, Unilabs is rapidly emerging as a serious contender. The burning question remains: Can Unilabs outperform Solana’s forecast in Q2 2025?

In this deep dive, we’ll analyze Solana’s current performance, explore what makes Unilabs stand out, and compare their prospects for the upcoming quarter.https://crypto.news/

1.Solana (SOL): The Current Bullish Run

Solana has been a staple in the Layer-1 blockchain space, often referred to as the “Ethereum Killer” thanks to its high transaction throughput and low fees. After a challenging 2024, Solana seems to have found its footing again in 2025, with key indicators pointing towards renewed bullish momentum.

Key Highlights:

30%+ monthly rally, pushing SOL price from $140 to recent highs of $184.

Critical support at $165 successfully defended.

On-chain activity increasing, including DeFi usage and NFT transactions.

Transfer volumes surging, indicating rising investor interest.

Solana has also celebrated significant network milestones, including improved scalability and partnerships aimed at enhancing its DeFi ecosystem. After dropping to lows of $97, SOL’s recovery to $184 has reignited investor confidence. However, it faced resistance around the $180 mark, leading to concerns of a short-term correction.

2.Unilabs (UNIL): A New Challenger Emerges

While Solana continues its upward trajectory, Unilabs (UNIL) is quietly laying the foundation to disrupt the decentralized finance space. Unilabs differentiates itself by merging artificial intelligence (AI) with DeFi, aiming to democratize access to high-quality crypto investments.

What is Unilabs?

Unilabs is an innovative DeFi protocol leveraging AI to offer automated asset management solutions. Its proprietary AI engine continuously scans the crypto market, identifying projects with strong fundamentals and allocating assets accordingly. This data-driven approach eliminates emotional biases and provides users with optimized portfolio strategies.

Key Achievements:

Over $30.3 million AUM — impressive for a relatively new platform.

Raised $300,000+ in presale funding.

Entry price of just $0.0051, making it accessible to retail investors.

Focused on automated asset allocation using AI.

Aims to democratize investment opportunities for everyone, not just institutions.

By simplifying the investment process and providing retail investors with tools usually reserved for professionals, Unilabs is tapping into a massive market demand.

Why Unilabs Matters:

AI-driven investment strategies offer precision and adaptability.

Growing interest in AI + DeFi convergence.

Strong AUM growth signals early adoption and trust.

Low entry price offers significant upside potential.

As the crypto space evolves, platforms like Unilabs that blend AI with DeFi are poised to capitalize on this next wave of innovation.

3.Unilabs vs. Solana: Head-to-Head

| Metric | Solana (SOL) | Unilabs (UNIL) |

|---|---|---|

| Market Cap | ~$80 billion (2025 est.) | Early-stage project |

| AUM / TVL | $5B+ in DeFi TVL | $30.3M Assets Under Management (AUM) |

| Transaction Speed | ~65,000 Transactions Per Second (TPS) | N/A (Not a Layer-1 Chain) |

| Main Focus | Layer-1 Blockchain, DeFi, NFTs | AI-Powered DeFi Asset Management |

| Recent Growth | 30% Monthly Rally | $300K+ Raised in Presale |

| Entry Price | ~$180 per SOL | $0.0051 per UNIL Token |

| Innovative Edge | Scalability & Speed | AI-Driven Portfolio Automation |

Key Takeaways:

Solana is a Layer-1 infrastructure play, with proven scalability and an established ecosystem.

Unilabs is carving out a niche in AI-powered DeFi, targeting users who want simplified, automated investment solutions.

While Solana is a “blue chip” in crypto terms, Unilabs offers high-growth potential at a much lower entry cost.

Both projects cater to different segments but have strong upside potential in Q2 2025.

4.Market Sentiment & Potential Catalysts

Market Sentiment:

Unilabs is garnering attention as an innovative entrant in the DeFi space, leveraging artificial intelligence to automate investment strategies. With over $30 million in assets under management (AUM) and a presale price of $0.004, early investors have seen a 27.5% return as the token price approaches $0.0051 . The platform’s AI-driven approach is attracting retail investors seeking exposure to early-stage crypto opportunities .The TribuneNewsWatchTVCoinpedia Fintech News

Potential Catalysts:

- AI-Powered Investment Strategies: Unilabs employs decentralized protocols and smart contracts to automate investment strategies, providing users greater control and transparency .

- Structured Reward System: The platform offers a five-tier reward system, redistributing 30% of fees to token holders, incentivizing long-term participation .

- Market Positioning: Positioned as the first AI-powered DeFi asset manager, Unilabs is challenging established platforms by offering early-stage investment opportunities to retail investors .The TribuneNewsWatchTVCoinpedia Fintech News

Solana (SOL): Established High-Speed Blockchain

Market Sentiment:

Solana maintains a strong position in the crypto market, with its price hovering around $173.01 USD . The platform’s scalability and speed continue to attract developers and investors, contributing to its resilience in the face of market fluctuations.

Potential Catalysts:

- Technological Advancements: Upcoming upgrades, such as the Firedancer mainnet and a new consensus mechanism, aim to enhance throughput and resilience, potentially doubling block space .

- Regulatory Developments: The potential approval of a Solana Spot-ETF, with an estimated probability of 80–90%, could significantly boost institutional investment .

- Market Predictions: Analysts forecast that Solana’s price could reach between $250 and $270 by October 2025, driven by sustained network utility and adoption in DeFi and NFT sectors

Comparative Overview

| Metric | Unilabs (UNIL) | Solana (SOL) |

|---|---|---|

| Market Position | Emerging AI-driven DeFi platform | Established high-speed Layer-1 blockchain |

| Assets Under Management | $30.3 million AUM | $5B+ in DeFi TVL |

| Transaction Speed | N/A (Not a Layer-1 chain) | ~65,000 TPS |

| Main Focus | AI-powered DeFi asset management | Layer-1 blockchain, DeFi, NFTs |

| Recent Growth | $300k+ raised in presale | 30% monthly rally |

| Entry Price | $0.0051 per UNIL token | ~$180 per SOL |

| Innovative Edge | AI-driven portfolio automation | Scalability & speed |

5.Risks to Consider

Before investing in either Solana or Unilabs, it’s essential to weigh the risks associated with each project. While both offer promising upside, they also come with unique challenges.

Solana (SOL) Risks:

- High Competition: Faces increasing competition from other high-performance Layer-1s like Avalanche, Sui, and Aptos, which are gaining developer and investor attention.

- Regulatory Pressure: Heightened scrutiny around DeFi protocols, staking mechanisms, and Layer-1 tokens may impact Solana’s operations and partnerships.

- Historical Network Outages: Solana suffered several network outages between 2022–2023, raising concerns over reliability and scalability under heavy demand.

Unilabs (UNIL) Risks:

- New Entrant Challenges: As an early-stage project, Unilabs must overcome hurdles related to brand trust, user acquisition, and platform validation.

- Execution Uncertainty: Success hinges on whether the team can effectively deliver on its AI-driven DeFi automation promises.

- Market Volatility: As with many presale tokens, macro and micro market conditions could heavily impact its token launch and near-term valuation.

- Liquidity Concerns: Low trading volumes in the early stages could result in high slippage, price swings, and limited exit opportunities for investors.

6.Can Unilabs Surpass Solana’s Growth in Q2?

In absolute terms, it’s highly unlikely that Unilabs (UNIL) will surpass Solana (SOL) in market cap or trading volume during Q2 2025 Solana’s scale is vastly larger, with a market capitalization around $80 billion and deep integration in DeFi, NFTs, and Web3 infrastructure.

However, when evaluating percentage-based growth, Unilabs has the upper hand in potential acceleration.

Example Comparison:

| Token | Current Price | 100% Gain Target |

|---|---|---|

| Solana (SOL) | ~$180 | $360 |

| Unilabs (UNIL) | ~$0.0051 | $0.0102 |

Achieving a 100% gain is significantly more feasible for an early-stage token like UNIL, especially during a bullish quarter with strong retail participation.

Why Unilabs Could Outperform (in % terms):

- AI Hype Cycle: Unilabs rides the growing narrative of AI-integrated DeFi, an emerging frontier that excites both retail and institutional investors.

- Low Market Cap Advantage: Early-stage tokens can experience explosive upside with relatively modest capital inflows.

- Presale Momentum: With over $30.3 million AUM and $300K+ raised, Unilabs is showing signs of strong early interest.

- Innovative Model: Its AI-driven asset management system and reward-based tokenomics differentiate it from traditional DeFi platforms.

Final Verdict: Who’s the Next Big Winner?

Both Solana and Unilabs are poised for strong performance in Q2 2025 — but they cater to very different investor profiles.

Solana is consolidating its status as a top Layer-1 blockchain, backed by robust on-chain activity, growing DeFi/NFT ecosystems, and the potential launch of a Spot ETF. With technical upgrades on the horizon, SOL has a realistic shot at reaching $200+ this quarter.

Unilabs, on the other hand, is a rising star in the AI-powered DeFi space. With over $30.3 million in assets under management, an innovative portfolio automation platform, and a token price still under one cent, UNIL offers asymmetric upside — perfect for high-risk, high-reward strategies.

Investment Takeaways:

- Conservative investors may lean toward Solana for its stability, liquidity, and proven infrastructure.

- Early-stage investors looking for disruptive growth potential could find Unilabs a strong speculative bet.

In truth, both projects can coexist and thrive in the upcoming market cycle — each riding different macro and narrative waves. A diversified approach, allocating to both, could offer the best of both worlds: stability and explosive growth potential.

TL;DR:

- Solana (SOL): Eyeing a $200+ price target with strong Layer-1 adoption and ETF momentum.

- Unilabs (UNIL): Raised $30.3 million AUM, offering AI-driven DeFi innovation at a low entry price.

- UNIL’s small-cap status makes triple-digit percentage gains plausible in Q2.

- Both are worth watching closely as momentum builds in the 2025 crypto bull cycle. see